“The Rat Race” – our everyday life laden with debt

Did you ever wonder how your life would be if you were living in a debt-free country? Actually, there are very few debt-free countries in the world and our chances to live in one of them are negligible. Myself, I have never had a change to live in one of them, but I guess it would be a completely different world.

But should we complain? Those of us who are the citizens of the so-called “rich economies” are still lucky. At least, this is how we feel about it. This feeling is further reinforced especially when we compare ourselves with the countries embroiled in perpetual wars, or those with a starving population. At the end of the day, it could be worse.

But are these “rich economies” really rich? Let’s first consider what “rich” in terms of money means.

For me, it means a few things. My net wealth is substantial. It provides me with an adequate level of a passive income that allows me to sustain a good quality of life and at the same time discharges me from my wage dependency. I can choose to work if I want to. If my situation was as the one just described I would consider myself rich.

So, how is it possible that so-called “rich countries” are the countries with the largest debt? At the same time, the “poor countries” (with a few exceptions) have the lowest debt. Isn’t it some kind of a paradox when considering what “rich” in terms of money means? There is no doubt that in the modern economy being rich means being in debt.

What does this “wealth” turn our everyday life into?

Simply saying, it turns it into a “rat race”. For me, this is an exact description of our everyday life. We must not only run faster and faster to keep up with the constantly changing world but we must also run faster than the others, otherwise we will stay behind. Try to slow down or stop for a moment and your “wealth” will disappear in a blink of an eye.

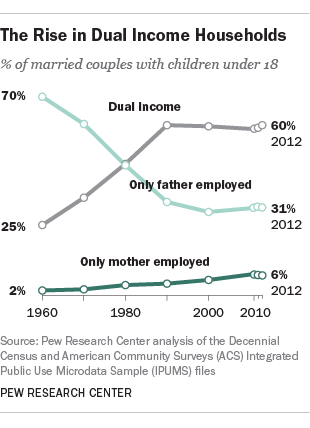

This is because more and more of us become wage dependent. When it comes to families, quite often one salary is not enough to support a good living, causing the number of dual-income families to rise. The below graph shows how this situation has changed since the 1960s in the USA – the “richest” economy in the world.

But let’s be clear, the similar trend is observed in the UK. The burden of debt became so big that a debt itself became a form of an additional income. How many families have a privilege to go to a car dealer and buy a good quality car with cash? How many families can fully equip a house with good quality furniture, electrical goods, and other necessary items without using some kind of deferred payment methods? This situation further reduces our disposable income which is already inadequate to the cost of living and makes us, even more, wage dependent. Obviously, our economy responds to this problem. We are literally flooded with cheap, rubbish goods with a limited life span. We keep buying those goods as that is all we can afford. When it comes to buying a car we don’t buy them anymore we lease them. This may turn out to be a cheaper option knowing that today’s cars don’t last and their repairs cost a fortune. Would I exaggerate if I said that the current “wealth” of an average family in developed countries is – a life-long mortgaged house, a leased car and household goods bought on credit!

In the debt–based economy, employment security is also undermined. As companies fight for profit and market share, cutting costs and mass production becomes a common practice that leads to nothing but fewer jobs. And yet the quality of jobs that are retained is getting worse. Wages decrease compared to the cost of living, pressure for longer-hour working days increases, work-related stress increases, and the overall job’s satisfaction decreases. However, the burden of debt makes us hang on to these jobs and feel lucky to have one.

So we are running even faster thinking, “I will eventually get there”. This is when an “unexpected” financial crisis hits us and completely wipes off our dream of financial freedom – a dream that many of us don’t even have. The trend is rather self-explanatory, every new century brings more and more financial and economic crisis. We are only in 2017 and have almost experienced as many economic crises as people in the whole 20th century!

Let’s not be deluded that this situation cannot last forever. At some point, it will come to an end. We may feel OK for now only because we still have the possibility to spread our burden of debt payment over a constantly increasing period of time. Like in the case of Greece or Italy, the seeming prosperity finally comes to an end.

Understanding money and our debt-based system is not a nice thing to know. It became an urgent matter not only for us but unfortunately for our children too. We must equip them with the necessary knowledge so that they can continue the work we have started today, and enjoy a better future.

We must not forget, money is a man-made invention and can be changed by a man to serve a society.

If you believe the current economic system and its effects on the environment need to be changed, and want to inspire the younger generations to take action, then why not help them understand the true nature of money and its effects with the Money Mystery Book Series today. The Money Mystery series goes beyond the typical what is money and how to save type books! The series has been developed to raise an awareness of the link between money and social and environmental problems, and foster the creation of the new, independently and critically thinking generation that will drive positive changes in our society.